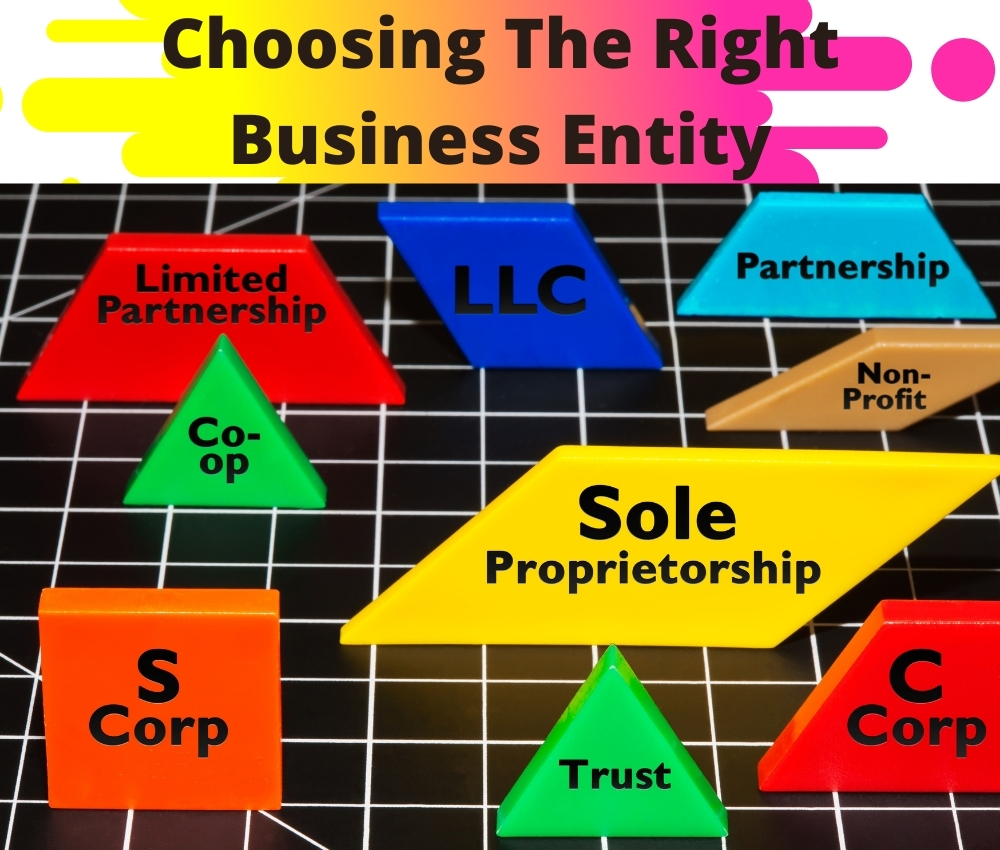

Here are some tips for Choosing The Right Business Entity: A business entity is a commercial, corporate and/or other institution that is formed and administered as per commercial law in order to engage in business activities, usually for the sale of a product or a service. Basically, an entity is what allows you the ability by law to conduct business.

There are many types of business entities defined in the legal systems of various countries. These include corporations, cooperatives, partnerships, sole traders, limited liability companies and other specifically labelled types of entities. Each country has its own type of entities that can be filed for so that a company can be created and operate.

A Sole Proprietorship is a business consisting of a single owner, not in a separately recognized business form. A sole proprietorship, also known as the sole trader or simply a proprietorship, is a type of business entity that is owned and run by one individual or one legal person (e.g. corporation, LLC) and in which there is no legal distinction between the owner and the business. Basically, the person IS the business.

The owner receives all profits (subject to taxation specific to the business) and has unlimited responsibility for all losses and debts. Every asset of the business is owned by the proprietor and all debts of the business are the proprietor’s. It is a “sole” proprietorship in contrast with partnerships (which have at least 2 owners). With a sole proprietorship YOU are liable for your business debts because YOU are the business.

A General Partnership is a partnership in which all the partners are jointly liable for the debts of the partnership. It is a partnership in which partners share equally in both responsibility and liability. Liability for business debts is much the same as a sole proprietorship but there are multiple “partners” involved instead of just one person.

A general partnership refers to an association of persons or an unincorporated company with the following major features: Created by agreement, proof of existence and estoppel and formed by two or more persons. The owners are all personally liable for any legal actions and debts the company may face.

A Limited Liability Company (LLC) is a form of business whose owners enjoy limited liability, but which is not a corporation. A limited liability company is a flexible form of enterprise that blends elements of partnership and corporate structures. An LLC is not a corporation; it is a legal form of company that provides limited liability to its owners. LLCs do not need to be organized for profit.

A limited liability company (LLC) is a hybrid business entity having certain characteristics of both a corporation and a partnership or sole proprietorship (depending on how many owners there are). An LLC, although a business entity, is a type of unincorporated association and is not a corporation.

GUARANTEED Minimum of $100,000 capital raise for any business, no matter your credit score 💲💲💲

A Corporation is a separate legal entity that has been incorporated either directly through legislation or through a registration process established by law. Incorporated entities have legal rights and liabilities that are distinct from their employees, shareholders, and members, and may conduct business as either a profit-seeking business or not-for-profit. Despite not being human beings, corporations, as far as the law is concerned, are legal persons, and have many of the same rights and responsibilities as natural people do.

A corporation may be either a Subchapter S Corporation or a C corporation. An S corporation is a corporation that makes a valid election to be taxed under Subchapter S of Chapter 1 of the Internal Revenue Code. In general, S corporations do not pay any federal income taxes. Instead, the corporation’s income or losses are divided among and passed through to its shareholders. The shareholders must then report the income or loss on their own individual income tax returns.

Choosing the right entity for your business is essential for maximizing your tax benefits while limiting your personal liability.

Give me a call today to learn more about how you can get credit and financing for your business.

GUARANTEED Minimum of $100,000 capital raise for any business, no matter your credit score

GUARANTEED – A minimum of $100,000 capital raise for any business, no matter your credit score.

SUPERCHARGE Your Business PROFIT$

Do You Want To Achieve Everything In Life?

10 Effective Strategies to Boost Your Website’s Google Ranking

Discover 10 effective strategies to boost your website’s Google ranking. In today’s digital landscape, securing a spot in the top 10 Google search results can

Who Will Buy My House for Cash? Exploring Your Options for a Swift Sale

Who will buy my house for cash? here we will be exploring your options for as swift sale. In today’s fast-paced real estate market, selling

How to Accept a Cash Offer for My House? A Seller’s Guide

How to accept a cash offer for my house. In the dynamic world of real estate transactions, receiving a cash offer on your house can

Can I Sell My House for Cash? A Comprehensive Guide

In an ever-evolving real estate market, the question “Can I sell my house for cash?” is becoming increasingly relevant for homeowners looking to sell their

The Top 10 Ways to become Wealthy in 2023

Achieving financial success and becoming wealthy is a dream for many people. However, it’s not always easy to know where to start, especially with the

The Top 10 Effective Ways to Enhance Your Site’s Visibility and Ranking

In today’s digital era, it’s not enough to have a website; you need to make sure that your site is visible to your target audience.